Copley Equity Partners uses “procurement-as-a-service” to help portfolio companies drive down technology costs and generate capital to fund hiring and acquisitions

When Copley Equity Partners (Copley) added AuctionIQ (AIQ) to their portfolio in 2022, they foresaw potential for increased profit and growth based on high market demand for the procurement consultancy’s ability to help enterprises reduce technology expenses. Little did Copley suspect, however, that AIQ would also play an instrumental role in helping other Copley portfolio companies to grow. The private equity firm is seeing meaningful results from AIQ’s work reducing technology expenses and harvesting capital to fund growth initiatives, like adding head count, growing sales capacity, geographic expansion, and pursuing strategic acquisitions.

Interest rate hikes have caused growth-minded PEs to innovate

Funding growth initiatives was much more straightforward just a few years ago. Private equity firms could tap a ready supply of inexpensive external capital to fuel growth of their portfolio companies. Bank interest rates have doubled since 2022, and private market debt has increased in cost even more rapidly, changing the math for private equity firms. Many have been forced to experiment with unsavory alternatives to free-up operating capital, like budget cuts and layoffs.

Copley dug into their playbook to compensate for the new economic environment. They noticed that demand and customer satisfaction for AIQ’s expense reduction and procurement consultancy services was surging, so they tapped AIQ to try to work their magic for several of their portfolio companies. They were more than pleased by the results.

“Very quickly, AIQ was able to uncover significant opportunities for expense reduction for two of our portfolio companies,” said Greg Sonzogni, operating partner at Copley Equity Partners. “AIQ ran its reverse auctions and negotiated dramatically lower enterprise technology costs, which resulted in significant incremental dollars that we were able to use to fund our growth strategies.”

One success story is Tourmaline Partners, a trading solutions firm providing supplemental and outsourced services to investment managers. AIQ hosted a recent procurement auction that reduced Tourmaline’s cloud infrastructure expenses by 50 percent. That generated operating capital to enable the company to hire additional salespeople to continue its growth, and Copley projects a potential increase to the company’s valuation by eight figures.

Similarly, LJB, a national engineering firm that provides civil and structural engineering services, used AIQ to renegotiate and reduce its annual computer hardware expenses by more than 20 percent. LJB applied the cash savings to support its inorganic growth strategy, reducing the need for higher interest rate debt.

Technology expenses are high, and many companies are paying too much

According to Blake Wetzel, AIQ’s chief executive officer, enterprise technology expenses for midsized and large companies can be ballparked at eight to fifteen percent of a company’s annual revenue. These span a broad range of categories including hardware, software, SaaS, business outsourcing, telecommunications, technical services, billing software and services, cloud and data services, and network storage. Trimming the fat can return significant operating capital to the business.

Savings of the magnitude AIQ delivered for Tourmaline and LJB is common. Over the past two decades, AIQ reports savings, on average, of over 40 percent of client technology expenses.

“Our research shows that companies are paying enterprise technology expenses that are 79 percent higher than market conditions warrant,” says Wetzel. Although that level of over-payment may seem shocking, Wetzel insists it is not necessarily because contracts were poorly negotiated. “The competitive landscape for enterprise technology changes very quickly. Even good contracts, aggressively negotiated as recently as a year or two ago, should be inspected because the technology may have matured, or new competitors may have entered the market. Those factors yield high leverage for contract renegotiation.”

There are other factors that contribute to enterprises paying more than they need to for enterprise technology, Wetzel says. For example, companies often have multiple vendors performing the same or similar services, so they fail to capitalize on volume discounts they could get through vendor consolidation. This is particularly common for companies that have undergone mergers and acquisitions. Also, AIQ finds that nearly two-thirds of companies have poorly monitored auto-renew contracts that can saddle a company with outdated pricing, and can even result in a company continuing to pay for products and services that are no longer in use. Lastly, most companies suffer from the “expense creep” caused by SaaS vendors incrementally increasing their prices every year when the contract is due for renewal. As Wetzel puts it, “SaaS is a beneficial model, but if you manage SaaS vendors passively, you are tied to a system that will relentlessly become more expensive each year.”

The power of procurement auctions to drive down costs

Perhaps the most powerful tool to battle back against rising expenses is the procurement auction. AIQ’s benchmarks show procurement auctions are twice as effective for price reduction as traditional techniques like RFPs and direct vendor negotiation.

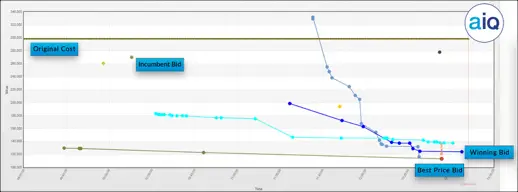

What makes this tool so successful? Wetzel explains that the secret sauce is a combination of competition and transparency. In a procurement auction, multiple vendors are invited to compete against each other for the buyer’s business. A procurement auction is a reverse auction, so each new bid drives the price lower. Bidding from all auction participants is transparent – participating vendors get real-time feedback of how they rank each time a competitor enters a new bid. This triggers them to compete by lowering their own bid. The combination of transparency and competition naturally compels suppliers to drive costs down well below their list prices, and often well below standard discounts. “Break out the popcorn, it’s actually pretty fun to watch,” laughs Wetzel. “A typical two-week auction involving a handful of vendors usually ends in a frenzy, with dozens of bids entered in the final hours.”

Figure 1 A typical two-week auction involving a handful of suppliers often produces hundreds of bids — usually concluding in a frenzy, with dozens of bids entered in the final hours, driving down the price well below list prices and standard discounts.

Procurement-as-a-Service

Midsized and large enterprises are hamstrung by two factors that limit their ability to fully optimize their supplier expenses. First, the pace of technology innovation makes it extremely difficult for internal staff to stay abreast of competitors, market dynamics, pricing, and licensing models. The second factor is capacity. It’s a tremendous amount of effort to work across multiple categories to analyze costs, identify good-fit vendors, and renegotiate contracts. That’s why procurement-as-a-service can be a compelling model for these companies.

“We were really impressed with the turnkey process,” said Michael Derr, executive vice president of operations & finance for LJB. “AIQ analyzed high-level data from our ERP to quickly uncover the biggest opportunities for savings. They interviewed our stakeholders to collect specifications, prescreened vendors, ran auctions, and came back to us with ready-to-execute contracts. Their service minimized the workload of our busy team.”

Conclusion

For years, private equity firms have faced a balancing act in ensuring that their portfolio companies have the resources to grow, but also operate in a cost-effective manner. Procurement-as-a-service solutions, such as those provided by AIQ, enable companies to reduce spend, maximize efficiency, and harvest cash to fund growth strategies, all of which are important to PE.

“Private equity is focused on increasing valuation, and procurement-as-a-service certainly impacts this, along with many other factors that are vital to a business,” says Sonzogni. “AIQ helps companies increase their enterprise value, and this is critical to attracting PEs that buy and sell those companies.”