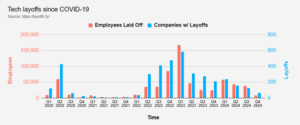

In 2023 and 2024, we saw a record volume of corporate layoffs (see Figure 1), especially in the technology, biotech, financial services, and retail sectors. The practice of using layoffs as a quick-fix tactic — favored by management consultants and embraced by public and private-equity (PE)-backed companies — is running out of steam following two years of relentless bloodletting.

Guess What? Layoffs Haven’t Worked.

Layoffs have a neutral to negative effect on stock prices and usually lead to declines in profitability, according to analysis of two decades of data1. Another study of Fortune 1000 firms over a five-year period determined that companies that conducted layoffs underperformed companies that did not, based upon multiple measures including return on assets, profit margin, and economic growth2.

Many private equity firms use layoffs to improve valuations and lure buyers to their portfolio companies. But even after cutting to the bone for the last two years, layoffs have not improved valuations sufficiently to inspire buyers. This is evidenced by the ongoing PE exit slump that has stubbornly persisted since the bottom fell out in late 2022 (see Figure 2).

Not only are layoffs failing to solve the business ailments they are intended to remedy, but they often inflict massive damage in terms of culture, growth, innovation, and productivity. Tesla is experiencing a culture collapse in the wake of their deep layoffs. After announcing they would lay off 14,000 workers in May 2024 and axing their entire Supercharger team, Tesla saw a group of core executives quit3. Rich Otto, Tesla’s head of product launches, wrote in his departure message that the job cuts have “thrown the harmony out of balance and it’s hard to see the long game.” Spotify laid off 10 percent of their workforce in December 2023, and their CEO Daniel Ek seemed stunned that remaining staff experienced operational difficulties causing them to miss guidance. “It did disrupt our day-to-day operations more than we anticipated,” admitted Ek in an earnings call a few months later4.

It’s Time to Try Something New

Year after year, layoffs prove to be a terribly inefficient method of cost-cutting and growing EBITDA. Any savings in salary expenses are whittled away by the cost of severance payments and higher unemployment insurance rates. In many instances, companies hire back their laid off employees or their replacements as contractors, merely shifting the expense from one cost center to another. In the next boom cycle, a company may well need to go back to the market and compete with others to hire for the same positions, effectively buying labor at a high price after having sold low. The surviving staff are discouraged, stressed-out, and less productive. And the smaller team has less capacity to handle the daily workload.

Explore alternative cost-cutting measures targeting enterprise technology.

A more effective way to cut costs — without taking a hatchet to operational capacity and corporate culture — is to optimize the company’s enterprise technology expenditures. Enterprise technology and adjacent expenses are estimated to be 20 percent or more of a medium or large company’s annual expenses. Research shows companies are spending nearly 80 percent above the true market value for products and services including telecommunications, cloud and data services, SaaS, billing services, computer hardware, and BPOs.

Companies are paying well above market value for a variety of reasons. Businesses rarely question the relentlessly increasing costs of SaaS, which are commonly up-charged ten to thirty percent annually upon renewal. Many organizations neglect to properly manage auto-renew supplier contracts, oftentimes continuing to pay for products and services after they are no longer in use. Using multiple vendors for the same or similar solution is commonplace, representing an opportunity for companies to consolidate vendors and negotiate better volume discounts. Costs become highly negotiable as technology matures and new competitors enter the market. By employing strategic negotiation and supplier optimization strategies, businesses can save hundreds of millions of dollars in expenses and return operating capital to the bottom line.

Procurement Auctions Drive Down Costs

A powerful mechanism for driving down costs is the procurement auction, which is proven to be more than twice as effective for cost reduction as traditional RFPs or direct one-to-one vendor negotiations. Competing suppliers are pitted against each other to earn business. Auction participants are alerted each time a competitor enters a bid, triggering them to lower their own bid. A typical two-week auction involving a handful of vendors often produces hundreds of bids, usually concluding in a frenzy, with dozens of bids entered in the final hours. Auctions are powerful tools for finding new vendors that cost less and better fit the buyer’s needs. They’re also effective for simply reducing the cost of incumbent vendors already in use. In fact, it is common that an incumbent vendor will drop their price by 20 or 30 percent as soon as they are notified that the product or service is going to auction.

Preserve Corporate Culture

History shows that the competitive advantage goes to companies that do not rely on layoffs as a standard cost-cutting tactic. Corporate culture is an indispensable asset for any successful business. Preserving it is key. Layoffs reduce innovation and operational capacity and produce organizational drag that erodes any forecasted benefit. Finding alternative strategies, like renegotiating technology costs, will go a long way to preserving cash and ensuring that the company is properly positioned for the future.

References:

[1] https://www.researchgate.net/publication/306222588_Employee_downsizing_and_organizational_performance_What_do_we_know

[2] https://www.jstor.org/stable/43489371

[3] https://fortune.com/2024/05/09/tesla-layoffs-morale-rich-otto-pound-of-flesh/

[4] https://fortune.com/europe/2024/04/23/spotify-earnings-q1-ceo-daniel-eklaying-off-1500-spotify-employees-negatively-affected-streaming-giants-operations/